When you’re taking up a home loan in Singapore, it’s important to know what your options are. Depending on your type of property, you may have the choice of fixed rate home loans or floating rates. But which is better for you? Are fixed rate home loans better than floating rates?

In this article, we’ll tell you more about fixed rates and why you should choose them. If you’re looking for more information on floating rates or fixed deposit-linked rates if you need more information.

What are fixed rate home loans?

Fixed rate home loans are home loan packages where the interest rates do not change for a specific period of time. This is a commitment the banks make to you. Fixed rates often give you peace of mind, knowing that your home loan interest rates will not change overnight.

However, you traditionally pay a premium for that security. Fixed rate home loans are often pegged at a higher interest rate than other home loan packages. There might be no risk of bill shock, but you may end up paying more interest on your home loan in the long run.

3 things you might not know about fixed rate home loans in Singapore

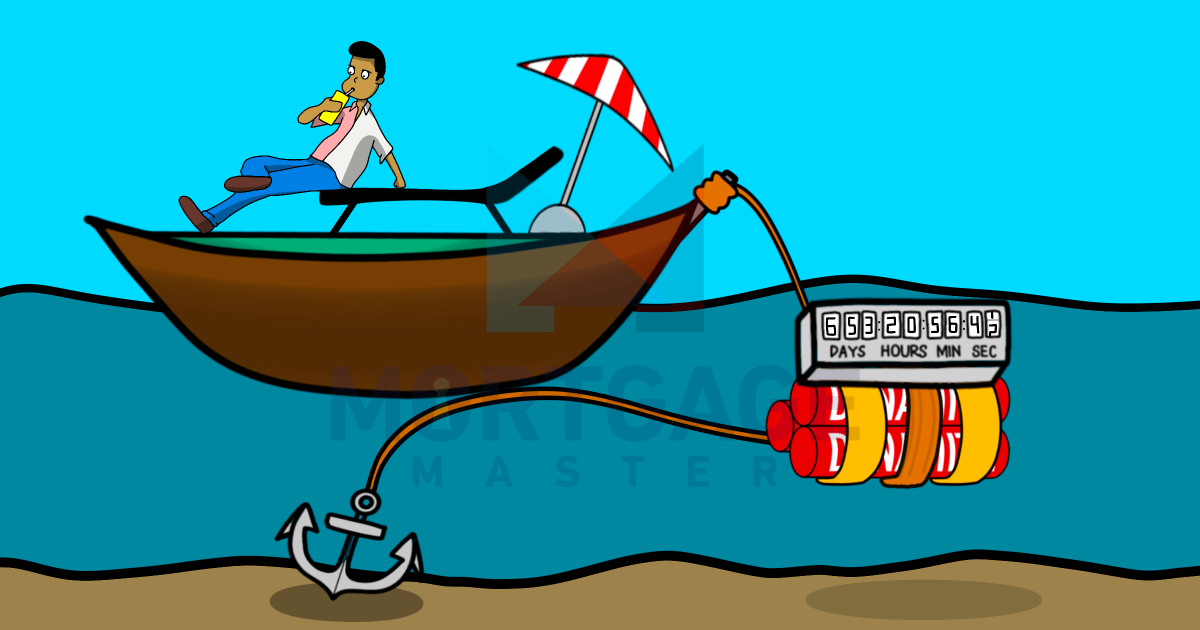

- Fixed rate home loans in Singapore are not fixed indefinitely. Most fixed rate home loans in Singapore only last 2 to 3 years, after which they automatically convert into a floating rate home loan.

- You won't be warned when it converts to a floating rate. Because banks love your money like ants love sugar, they will conveniently forget to tell you when your fixed rate home loan package eventually converts to a floating rate home loan. Since you should be eligible for refinancing by this point, remember to let your mortgage broker know when your fixed rate expires, so they can advise on refinancing.

- If you have a property under construction, such as a condo launch or BTO, you will not eligible for fixed rates. Banks often want to lock you into a home loan package for the duration of the construction. Since this can take up to 3 or 4 years, banks don’t offer fixed rates for buildings under construction.

When are fixed rate home loans better than floating rates in Singapore?

The best time to choose fixed rate home loans is when you expect the interest rates in floating rate home loans to rise significantly over the next two to three years. If floating rates rise higher than your fixed rates, you will save money.

During the low-interest period between 2010 and 2015, fixed rate home loans were pegged at 1.8%. However, floating rates during this era did not rise above 1.8%. Those who took fixed rate home loans ended up paying more in the long run.

So unless you die-die can predict the future, remember that choosing a fixed rate home loan is still a gamble - whether you save money depends on how heng suay you are. And if you CAN predict the future, do you mind sending me a DM with next week’s winning 4D numbers? Thanks in advance!

Seriously, though, choosing a fixed rate home loan also depends on your risk appetite and financial situation. Some homeowners are happy and willing to spend a bit more if it means being able to set aside a fixed amount of money to pay off your home loan each month. It definitely makes things more convenient.

Should you choose fixed rate home loans?

It is the job of a mortgage broker to advise you about your options when it comes to home loans in Singapore. At Mortgage Master, based on our years of experience in the industry, we know best when fixed rate home loans are suitable for your financial situation, and whether they can save you money in the long run.

Interested in signing up for fixed rate home loans? Give us a call today or drop us a WhatsApp message and let us help you confidently make this important decision in your life.

Want to know more about home loan interest rates?

Read our series of articles and familiarise yourself with everything you need to know about home loans in Singapore: