You’ve finally chosen your dream home! It’s in the best neighbourhood with all the amenities you need, within walking distance of the MRT station and all the good schools are just 10 minutes away. And then you look at the price tag - it’s more than you’ll make in 20 years! That’s why you need a home loan. But you don’t know anything about home loans in Singapore! How are you going to make the biggest financial decision of your life?

What do these home loan terms even mean?

You hear words like “home loans”, “interest rates” and “lock-in periods”. Then there’s “floating rates” and “fixed deposit-linked rates”! These are words you may understand individually, but you have no idea what they mean when you put them together. And by the time you reach the acronyms like “HLE”, “AIP”, “LTV” and “OTP”, you’re ready to give up buying that dream home.

Home loans in Singapore and how to master them

At Mortgage Master, we want to guide you through the process of applying for the best home loan in Singapore. We’ll teach you what to look out for, what to avoid and most importantly, how to save money in the long run. Because when it comes to home loans, kiasu is good.

Our website will help you answer the following 3 questions:

- Which is better for me - fixed rates or floating rates?

- Which floating rate should I choose - SORA or fixed deposit-linked rates?

- Which bank’s home loan package should I choose?

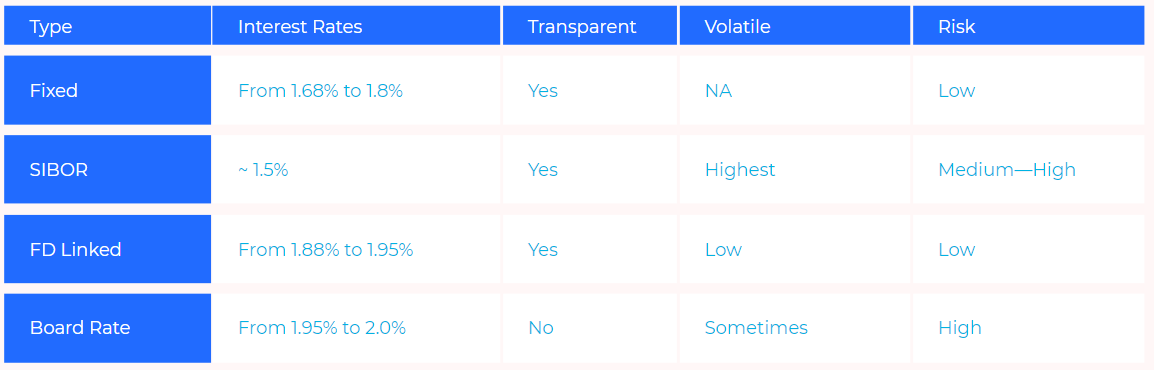

Let’s start with a very quick summary of the four types of home loans available in Singapore.

Home loans in Singapore pros and cons

When it comes to home loans in Singapore, there are 5 important factors to consider when choosing a home loan package:

- Are the rates transparent?

- Are the rates volatile?

- Is there a lock-in period?

- What are the risks?

- What is the interest rate being offered?

Is your home loan rate transparent?

Most home loan packages in Singapore are transparent. That means you know exactly how your interest rate is calculated by the bank, and all the information is publicly available. This is important because you want to be able to make an educated guess if your home loan interest rate will rise or not.

One type of home loan package is not transparent. These are known as board rates. Only the upper management of a bank knows how they come up with the rates, and they have the right to change the rates at any time, by just giving you one month’s notice.

Learn more about board rates and why you should be careful when choosing one.

Is your home loan rate volatile?

You get to decide whether your home loan interest rate changes for month to month, or stays the same for years. There are pros and cons to be considered in all cases. For example, a more volatile interest rate may start low at first, but can change overnight to a higher interest rate. On the other hand a less volatile interest rate may be relatively high, but you might save money in the long run.

If your loan amount is low, a volatile interest rate may not be that bad. Let's take an extreme example. Say your outstanding loan is $250,000 over 15 years, and imagine a super-volatile interest rate leaps from 1.8% to 2.5% overnight. Sounds scary, right? But when you do the calculations, that's only $81 more a month, a very small amount in the grand scheme of things. Since more volatile interest rates are often the cheapest in the market, they are definitely worth considering when your loan amount is lower.

You should ultimately make the decision based on whether your financial situation can handle a monthly repayment amount that is volatile.

The very volatile SORA-linked home loan packages are popular now while interest rates are low, but SORA is starting to rise steadily this year (because SORA, like its predecessor, SIBOR is cyclical), it may no longer be a good idea.

Read more about SORA home loans and how to choose one.

Is there a lock-in period for your home loan?

Some home loan packages have a lock-in period. This means that if you take a home loan from Bank A, then after a few months change your mind and want to go with Bank B, you may suffer a significant penalty.

Knowing how long the lock-in period lasts will help you master your home loan decision. Typical lock-in periods are between 2 and 3 years.

The main thing to consider is your opportunity cost. During your lock-in period, you may not be able to refinance to take advantage of promotional interest rates when banks offer them. This is because the penalty of refinancing during the lock-in period is too high, so definitely keep that in mind.

If you choose a fixed rate home loan, you will definitely have a lock-in period. If you choose fixed rates, make sure you’re prepared to stick to this financial commitment for the next couple of years.

Find out more about fixed rate home loans and the pros and cons of this choice.

What are the risks of your home loan?

A home loan is a long term financial commitment. Probably the biggest amount of money you’ll ever spend in a lifetime! That’s why you should learn all the risks of home loans in Singapore so that you can be a Mortgage Master too.

Some home loan packages have lower risks than others. Lower risk usually means no bill shocks when it comes to monthly repayments. This is because interest rates for these home loan packages aren’t expected to rise as quickly as others.

A great example of a low risk home loan package are fixed deposit linked rates.

Learn more about fixed deposit linked rates and how to master them.

How much is the interest rate of your home loan?

The last but just as equally important factor when choosing a home loan is the current interest rate itself. This determines how much you can expect to pay in the first few months.

In general, the lower the interest rate, the better, but depending on your financial situation and property type, it might surprisingly be more prudent in the long run to start with a higher interest rate.

This is often determined on a case-by-case basis.

We are here to help you master mortgage!

At Mortgage Master, we understand that everyone has different risk appetites and also different levels of awareness when it comes to mortgage jargon.

Our mortgage consultants have many years of experience in the industry and are happy to answer all your questions about home loans in Singapore. We will even be able to advise you on the best home loan in Singapore based on your financial situation. So drop us a WhatsApp message and let us help you confidently make this important decision in your life.